Madhya Bhotekoshi Hydropower (Jalavidhyut) Published IPO Result on 29th October 2021 (12th Kartik 2078, Friday, 9 am). According to Global IME Capital, the issue and sale manager of Madhya Bhotekoshi Hydropower (Jalavidyut) Company Limited, the allotment was completed at 9 am on Friday.

The shares issued by Madhya Bhotekoshi Jalavidyut Company Limited (MBJCL) had issued 9 million units of shares worth Rs. 900 million to the general public from October 6 to 11.

Out of the total shares issued, 4 percent or 360,000 units of shares have been allotted for employees and 5 percent or 450,000 units of shares have been allotted for mutual investment funds. The remaining 81,90,000 units of shares will be distributed to the public.

According to the latest statistics, the MBJCL has received IPO applications from 2,393,428 applicants for 34,360,010 units. This is 4.19 times more than what was demanded from the issued to the general public.

As there have been more applications than demand for the shares of Madhya Bhotekoshi Hydropower, a minimum of 10 units of shares were allotted as per the Securities Issuance and Distribution Directive. Accordingly, 8,19,000 thousand people got 10 units of shares. The remaining 15,74,428 applicants did not get shares.

How to Check IPO Result of Madhya Bhotekoshi Hydropower:

Learn How to Check IPO result /allotment in Nepal. Learn the fastest and easiest way to check all companies' IPO results in Nepal. Follow a few steps to check an IPO result.

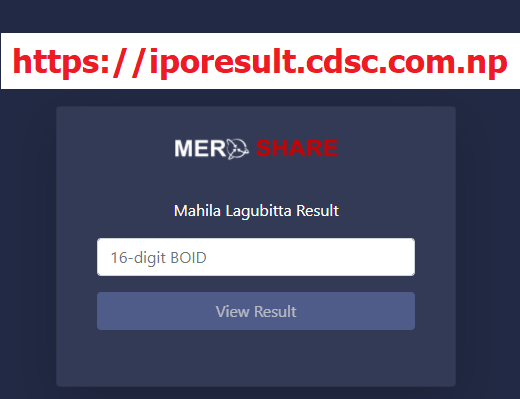

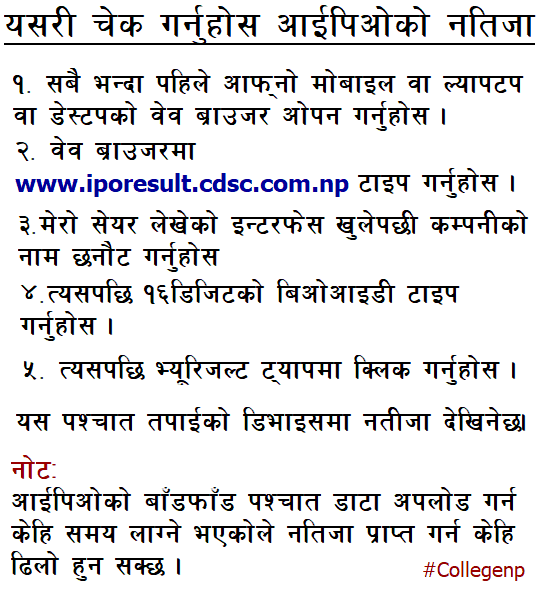

You have to follow the following instructions to check the IPO result of Madhya Bhotekoshi Hydropower (MBJCL) from the MeroShare (CDSC) website: iporesult.cdsc.com.np

Step 1: Log on to iporesult.cdsc.com.np (Check Here)

Step 2: You will view this type of interface on your device.

Step 3: Type your 16-digit BOID Number (Beneficial Owner Identification Number)

Step 4: Click on View Result Tab.

Finally, you will get the result message on the interface.

(Note: The IPO result will be shown after the share allotment and upload data on the server, it will take a few hours after the announcement)

Other Ways to Check IPO Result of Madhya Bhotekoshi Hydropower:

1. MeroShare Official Website: https://www.meroshare.cdsc.com.np

2. Global IME Capital Limited - Global IME Capital IPO result (Check IPO Result on Global IME Capital) Website: https://www.globalimecapital.com/ipo-fpo-share-allotment-check (Check Here)

(Please select company name and provide DEMAT No. to view IPO result Select Company name and Type DEMAT Number)

IPO Detail Statement:

| The IPO Issuing Company | Madhya Bhotekoshi Hydropower (Jalavidhyut) Company Limited |

| Issue Manager | Global IME Capital Limited |

| Security Type | Common Stock -IPO |

| IPO Issued Date | 2078 Ashoj 20 to 25 |

| IPO Face Value | Rs. 100 |

| Total IPO Share | 90,00,000 units |

| The share allocated for Mutual Investment (5%) | 4,50,000 units |

| The Share allocated for employees (4%) | 3,60,000 units |

| Total Share for Individual Investor (General Public = 91%) | 81,90,000 units |

| Total Applicants | 2,393,428 |

| Total Applied Units | 3,43,60,010 units |

| Total Allotted Kitta | 81,90,000 Kitta |

| Total Allottee | 8,19,000 applicants |

Company Profile:

Madhya Bhotekoshi Jal Vidyut Company Limited (MBJCL) has been registered in the office of the Registrar of Companies on 2067-4-13 as per the Companies Act 2063.

The Registrar's Office of MBJCL is located at Kathmandu Metropolitan City Ward No. 3, Maharajganj, Kathmandu. The company has a project office and a hydropower station. It is located in the former Barhabise Municipality-5 and Maming VDC (Bhotekoshi Rural Municipality) of Sindhupalchok district.

The company is constructing a 102 MW Madhya Bhatekoshi Hydropower Project based on Run of River.

The company currently has Chilime Hydropower, Nepal Electricity Authority, Sindhupalchok Hydropower, Sindhu Investment Company, Nepal Arani Hydropower, and Sindhu Bhotekoshi Hydropower Company as founding shareholders.

The total cost of the project is projected to be Rs 16.97 billion and Rs 166.4 million per MW.

The company has already distributed 6 million shares equal to Rs. 600 million, which is 10 percent of the issued capital of Rs. 6 billion, as per the provisions in the management letter and rules. A total of 15 million shares have been issued to the public by sharing 15 percent, i.e. 9 million shares equal to Rs. 900 million.

The company has stated that it will spend Rs 1 billion for the construction of civil hydro and electro-mechanical works, Rs 300 million for the construction of electro-mechanical works, and Rs 100 million for the construction of a 220 kV transmission line.

The company has stated that Rs 50 million will be spent for such consultancy and Rs 5 billion for project operation.

Capital structure:

At present, the company's paid-up capital is Rs 4.5 billion. The company's paid-up capital will reach Rs 6 billion after selling an IPO worth Rs 1.5 billion to locals and the general public. The company has an authorized capital of Rs 6.21 billion and issued capital of Rs 6 billion.

After the IPO, the company's share ownership will remain at 51 percent of the founder and 49 percent of the public.

Board of Directors:

The board of directors of the company has 11 members. There will be 5 members from the founding shareholders, 4 members from the general shareholders, and 2 independent members.

Until the sale of shares in any group other than the founder group, there will be a board of directors consisting of 4 members from Chilime Hydropower Company, 1 from Nepal Electricity Authority, 1 from Employees Provident Fund, 1 nominated by other founders, and one independent director. The company has stated that the post of independent director is currently vacant.

Harihar Neupane, who represents Chilime Hydropower Company, is the chairman of the company's board of directors. Similarly, Lekhnath Koirala, Tulasi Ram Dhakal, and Subhash Kumar Mishra from Chilime Hydropower Company are also members of the board of directors.

Dhrub Bhattarai from the Employees Provident Fund, Shri Ram Raj Pandey from the Nepal Electricity Authority, and Naresh Lal Shrestha from the Sindhu Investment Company are on the Board of Directors.

Ram Gopal Shivakoti, who has worked for Nepal Electricity Authority at various levels for 32 years, is the chief executive officer of the company.

Future plans and strategies:

The main strategy of the company is to establish itself as a leading company in the development of hydropower in Nepal. For that, the company plans to study the feasibility of new hydropower projects and reduce the energy crisis in the country to some extent by selling the electricity generated by constructing those projects to Nepal Electricity Authority.

The loan taken by the company from the provident fund will be repaid with the installment and interest as per the agreement after the completion of the project and full commercial production.

Another objective of the company is to identify, survey, construct, operate and manage potential hydropower projects by identifying potential hydropower projects in future plans and strategies as per the objectives mentioned in the management letter and to sell the electricity generated from those projects.

There are plans to jointly invest with other companies to survey, construct, operate and manage various hydropower projects or to establish a new company.