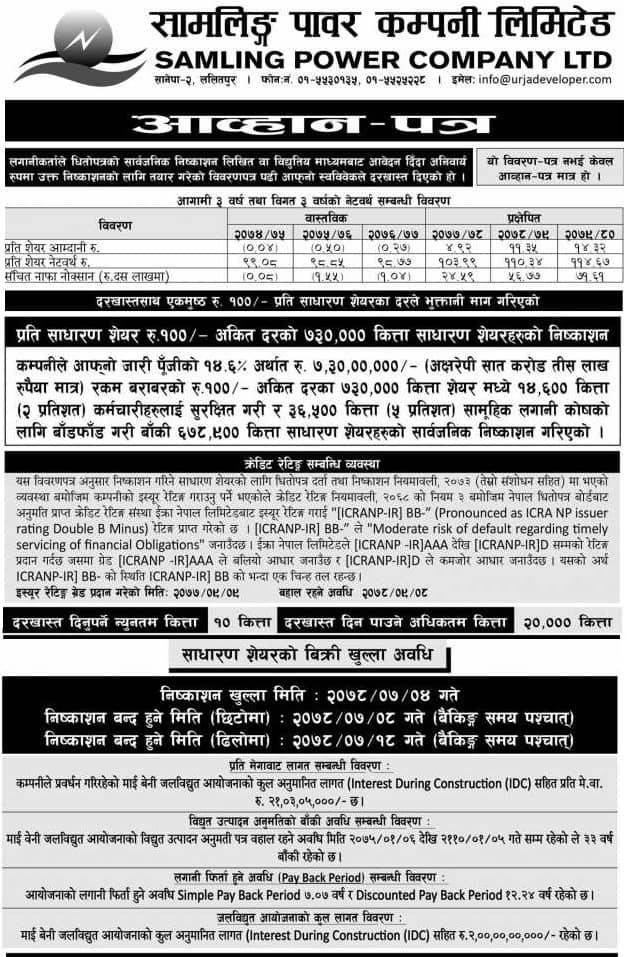

Samling Power Company Limited (SPCL) has launched its initial public offering (IPO) on Thursday, October 21, 2021. Samling Power Company has issued 730,000 shares worth Rs 73 million.

Out of the total shares issued to the public, only 2 percent or 14,600 shares will be allotted to the employees and 5 percent or 36,500 shares will be allotted to the mutual investment fund.

At present, the paid-up capital of Samling Power Company is Rs. 377 million. The company's paid-up capital will reach Rs 500 million after the issuance of shares worth Rs 123 million, including Rs 50 million to project-affected locals and Rs 73 million to the general public.

How to apply for IPO?

Applications can be submitted for the shares issued by Samling Power Company till 25 October 2021. If there are not enough applications as per the demand within that period, the deadline will be extended till 4 November 2021.

Investors interested in the IPO of Smalling Power Company will be able to apply for a minimum of 10 units at the rate of Rs 100 per lot and a maximum of 20,000 units in the number divided by 10 units.

All C-ASBA member banks and financial institutions approved by the Nepal Securities Board (NSB) can apply for SPCL's IPO from designated branch offices and also from the MeroShare mobile app.

The issue and sale manager of SPCL is Nepal SBI Merchant Banking and the guarantor is NIBL Ace Capital.

ICRA Nepal has given ICRA NP IR Double B minus rating to the IPO issued by SPCL. This indicates an average risk in SPCL's ability to meet financial obligations.

ICRA Nepal had given a rating grade to SPCL's IPO on 24 December 2020. The rating is valid for one year from the date of issue.

Overview:

Samling Power Company Limited was registered as a private limited company in the name of Samling Power Company in the office of the Registrar of Companies on 23rd Chaitra 2070 BS as per the Companies Act 2063 BS.

It has been operating as Samling Power Company Limited by transforming into a public company on 24th Jestha 2076 BS.

The Registrar's Office of the Company is located at Lalitpur Metropolitan City Ward No. 2 Sanepa Lalitpur.

The company's project office and hydropower station are located in Ilam Municipality former (Ilam Municipality and Godak VDC) and Maijogmai Rural Municipality (formerly Soyang and Namsaling VDC) of Ilam District.

SPCL has completed the construction work of the 9.51 MW capacity Maibeni Hydropower Project based on Run of River and has been operating the project since 1st Ashoj, 2078 BS.

The company has projected that the total cost of the project will be Rs 2 billion and the cost per megawatt will be Rs 213.05 million.

As per the provisions in the management letter and rules, the company has issued 10 percent of the issued capital of Rs. 500 million or 500,000 shares equal to Rs. 50 million to the locals and 14.6 percent or 730,000 shares equal to Rs. The shares have been issued.

The company has stated that it will use the Rs 123 million collected by issuing IPO to repay the loan.

The main objective of SPCL is to establish itself as a leading company in hydropower development in Nepal. For this, the company has a plan to make the country self-reliant in electricity by selling the electricity generated by constructing other hydropower projects after studying the feasibility of new hydropower projects.

Another objective of the company is to identify, license, survey, construct, operate and manage potential hydropower projects in future plans and strategies as per the objective mentioned in the management letter of SPCL and to sell the electricity generated from those projects.

There are plans to jointly invest with other companies to survey, construct, operate and manage various hydropower projects or to establish a new company.

Board of Directors (BOD):

The board of directors of SPCL has 11 members. There is an arrangement to have 7 members from the founding shareholders, 1 member from the general shareholders, 1 member from the shareholders of the project affected areas, and 2 independent board members.

At present, the board of directors of the company has 10 directors. Of them, 8 are founding shareholders and 2 are independent operators.

After the IPO issuance to the public, the company will select one more operator to represent the public. The term of the operator will be a maximum of 4 years.

The chairman of the board of directors of the company is Vijay Bahadur Rajbhandari. Chairman Bhandari has become the chairman of the company representing CE Construction.

Similarly, Shyam Milan Shrestha, Gopal Manandhar, Mohandas Manandhar, Shambhu Prasad Phuyal, Mohan Bikram Karki, Bhanubhakta Pokhrel, Mangala Amatya, Dinesh Shrestha, and Raju Shakya are on the board. Dinesh Shrestha and Raju Shakya are independent operators.

IPO IPO Date