Revolutionizing Peer-to-Peer Lending: The Pioneering Initiative by NCIT Students

Bringing a paradigm shift in the financial transaction domain, the Nepal College of Information Technology (NCIT) students have introduced an innovative Peer-to-Peer (P2P) lending application. This state-of-the-art project was unveiled recently at a college expo, demonstrating the forward-thinking capabilities of P2P lending.

Decoding P2P Lending

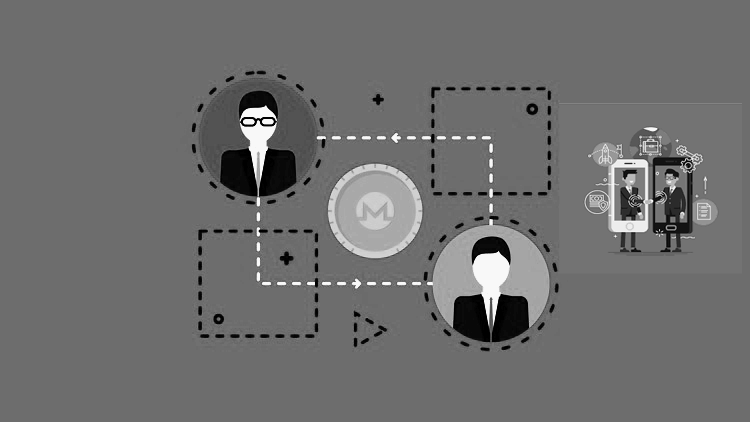

Peer-to-Peer Lending or P2P is a cutting-edge financial arrangement that enables individuals and organizations to transact funds for various requirements. This futuristic lending model is maintained and operated through online platforms, fostering seamless interactions between lenders and borrowers.

A dynamic team from NCIT – Bimalraj Gyawali, Dikshant Shah, Narendra Bahadur Chand, and Ramesh Baral – successfully converted this concept into a comprehensive web application.

Exploring the Features of the NCIT P2P Lending App

Designed to accommodate lenders and borrowers, the P2P lending app presents an intuitive platform where users can register and log in using their emails. The application encompasses a robust Know Your Customer (KYC) verification process, ensuring absolute credibility and security.

- A safe haven for individuals seeking loans for various purposes like business funding.

- An excellent platform for lenders to offer loans at fixed interest rates.

- A key feature that allows borrowers to repay in convenient monthly installments.

- A mechanism to ensure timely repayment of loans and establish a borrowing limit for financial discipline.

The Tech-savvy Aspect

This pioneering project was skillfully crafted using an amalgamation of advanced technology tools like HTML, CSS, JavaScript, React, Java, Spring, Rabbit MQ, and PostgreSQL.

Legal Aspects & The Road Ahead

The NCIT P2P lending app represents a significant leap in the financial sector, especially in Nepal, where such services are not legally recognized yet.

The student developers are optimistic that government-regulated frameworks could potentially open avenues for their P2P lending service, addressing critical issues like meter bagging. If realized, this app could revolutionize the financial transactions landscape in Nepal.

Tracing the Roots of P2P Lending

P2P lending, initially a computer network term for file transfers between two computers, has morphed into a revolutionary financial instrument. The model empowers individuals and organizations to transact loans for diverse purposes via online services, making it a simpler and often less stringent process than traditional bank loans or informal lending methods.

P2P Lending vs. Traditional Banking

Unlike traditional banking systems that entail multiple paper procedures and often demand collateral, P2P lending platforms facilitate direct disbursement of loans by investors, eliminating the need for physical presence. The associated risks, however, might be higher with P2P lending.

Advantages of P2P Lending

For investors or lenders, P2P lending platforms potentially offer higher returns compared to traditional financial institutions. Borrowers, on the other hand, can benefit from competitive interest rates and more transparency.

However, the absence of central bank regulation might pose higher risks for lenders. Despite this, the opportunity to diversify investments, earn higher interest, and access a wide array of debtors is appealing.

In conclusion, P2P lending, which initially surfaced in response to a credit crunch, is now reshaping the global financial landscape. By offering a compelling alternative to traditional banking, P2P lending is bridging credit gaps and creating new investment opportunities, thereby highlighting the increasing influence of digital transformation, especially in the financial sector.