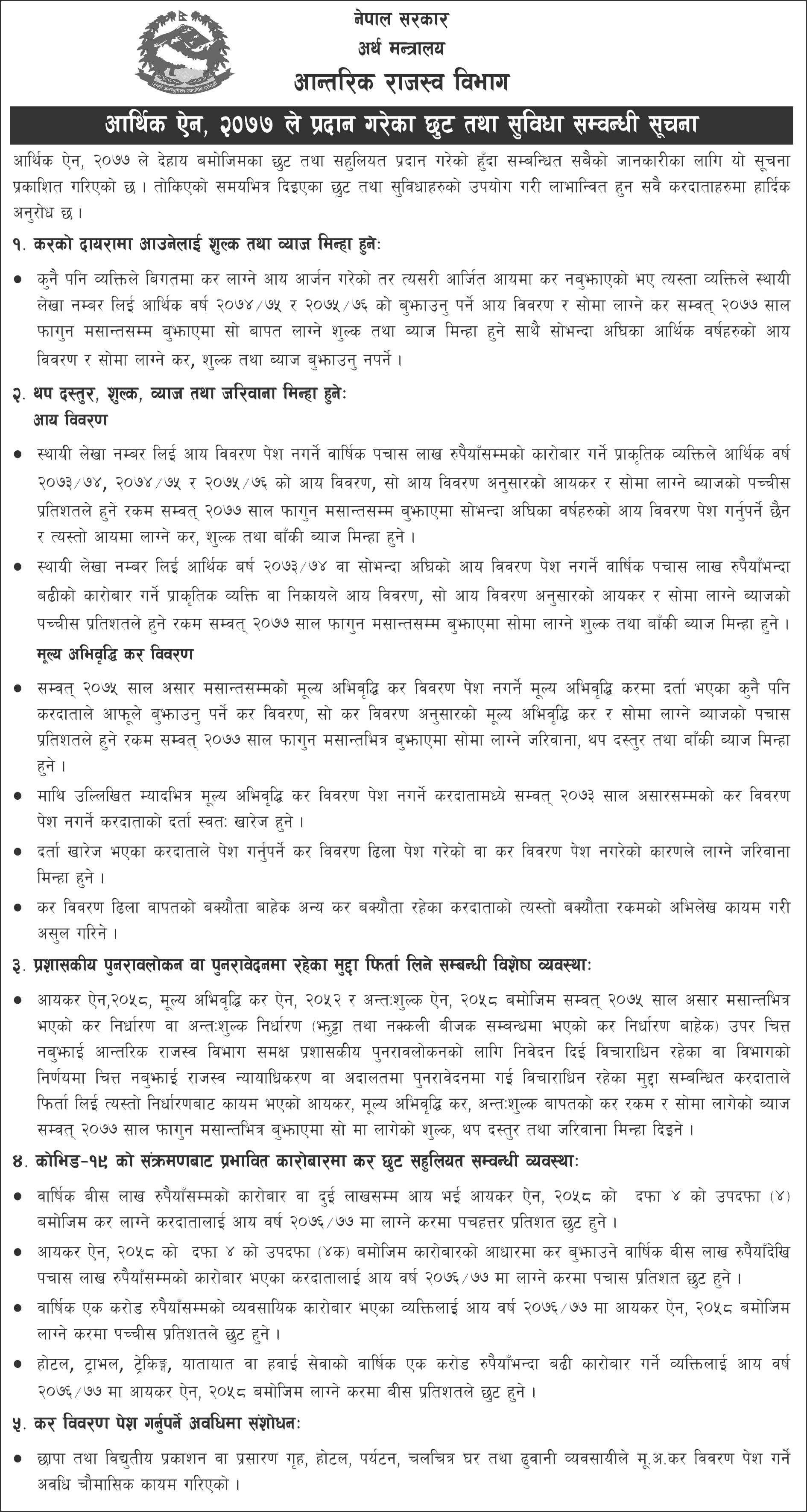

Ministry of Finance Notice Regarding Exemptions and Facilities Provided by the Finance Act, 2077:

Government of Nepal, Ministry of Finance, Inland Revenue Department

Notice regarding exemptions and facilities provided by the Finance Act, 2077:

This notice has been published for the information of all concerned as the following exemptions and concessions have been provided by the Finance Act, 2077 BS. All taxpayers are cordially requested to avail the benefits of the discounts and facilities provided within the stipulated time.

1. Fees and interest will be deducted from the taxable income:

If any person has earned taxable income in the past but has not paid tax on such income, such person should take permanent account number and submit income statement for the financial year 2074/75 and 2075/76 and pay the tax by the end of Falgun 2077. And the interest will be deducted and the income statement of the previous financial years and the tax, fee, and interest will not have to be paid.

2. Additional fees, charges, interest, and penalties will be deducted:

(A) Income statement:

- A natural person who does not submit an income statement with a permanent account number and does business up to Rs. 50 lakhs per annum. If submitted by, the income statement of the previous years will not have to be submitted and the tax, fee, and remaining interest on such income will be deducted.

- A natural person or entity doing business of more than Rs. 50 lakhs per annum without submitting an income statement for the fiscal year 2073/74 or earlier with permanent account number will be liable to pay interest till the end of Falgun 2077. Fees and remaining interest will be deducted.

(B) Value Added Tax (VAT) Details:

- Any taxpayer registered for value-added tax who does not submit VAT statement till the end of Ashad 2073 will have to submit tax details, Value Added Tax (VAT) as per the tax details, and fifty percent of the interest accrued by the end of Falgun 2077. , Additional fees and remaining interest will be deducted.

- Of the taxpayers who do not submit the VAT statement within the above mentioned period, the registration of the taxpayer who does not submit the tax statement by the end of Ashad 2073 will be automatically revoked.

- Penalties for late submission of tax returns or non-submission of tax returns will be waived.

- Tax Details Except for late payment arrears, other tax arrears will be recovered by maintaining records of such arrears.

3. Special provisions for administrative review or withdrawal of appeals:

Request for Administrative Review to the Inland Revenue Department for dissatisfaction with the Income Tax Act, 2058, Value Added Tax Act, 2052, and Excise Act, 2055. Not satisfied with the assessment of tax or excise duty (except for the assessment of tax on false and fake invoices) by mid-July 2075 BS. In case the taxpayer withdraws the case under consideration or appeals to the Revenue Tribunal or Court without considering the decision of the department and withdraws the income tax, VAT, excise tax, and interest incurred from such assessment, the fee will be charged. Duties and fines will be waived.

4. Provisions regarding tax exemption for businesses affected by the infection of COVID-14:

- Pursuant to Sub-section (4) of Section 4 of the Income Tax Act, 2058 BS, seventy-five percent tax exemption will be given to the taxpayer (with an annual turnover of up to Rs. 2 million or up to Rs. 200,000).

- Pursuant to Sub-section (4a) of Section 4 of the Income-tax Act, 2058, the taxpayer who pays tax on the basis of business will get fifty percent tax exemption in the income year 2076/77 (annual turnover of Rs. 2 million to Rs. 5 million).

- In the income year 2076/77, the tax levied under the Income Tax Act, 2058 will be reduced by twenty-five percent (with an annual turnover of Rs. 2 million to Rs. 5 million).

- Hotel, travel, trekking, transport or air service: A person (who trades more than Rs. 10 million per annum) will be exempted from tax by twenty percent in the tax levied in the income year 2076/77 as per the Income Tax Act, 2058.

5. Amendment in the period for filing tax returns:

The period for submission of VAT details by print and electronic publishing houses, hotels, tourism, movie theaters, and transporters has been fixed quarterly.

Notice: