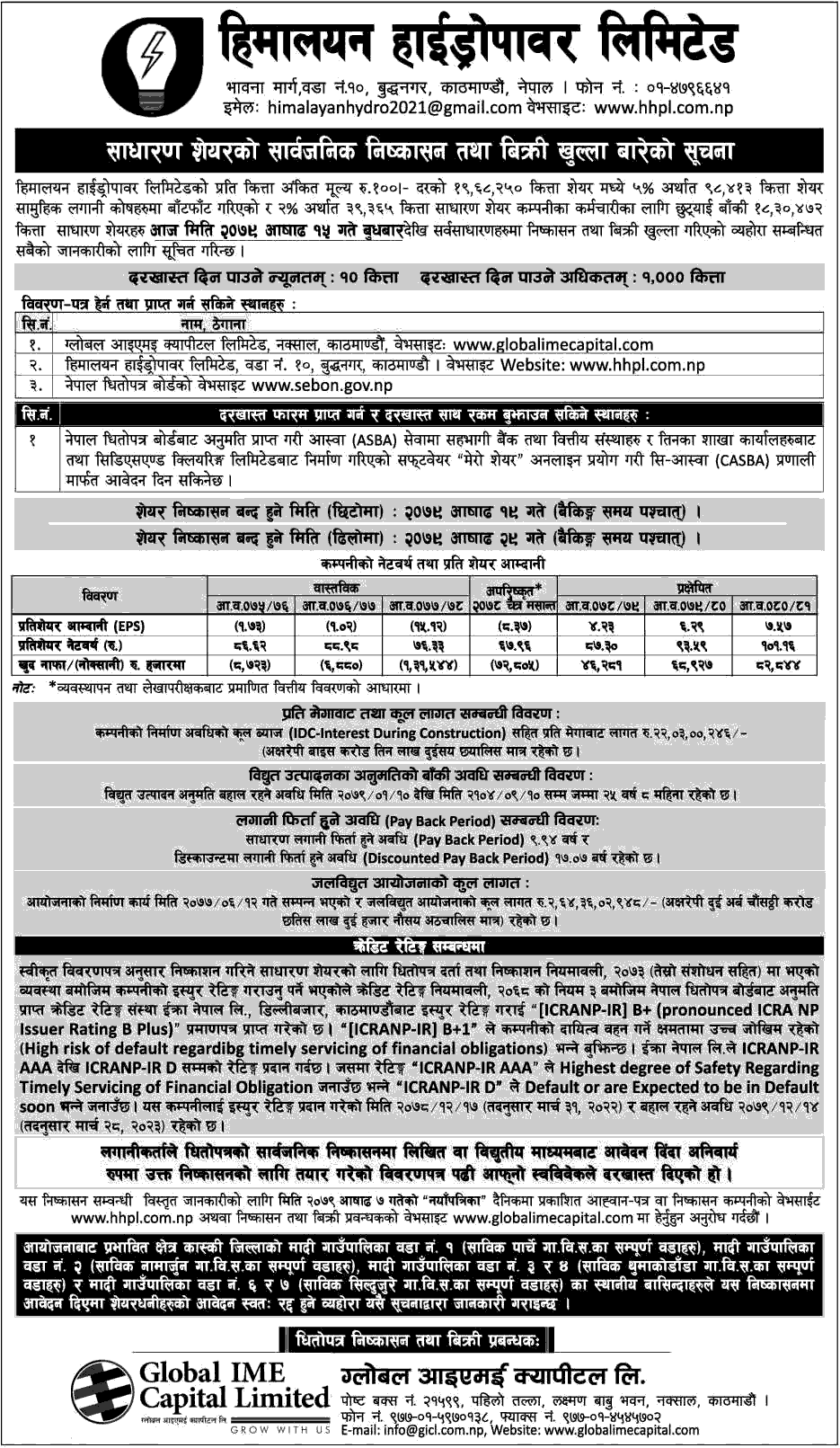

Himalayan Hydropower Limited is launching IPO issuance and sale from Ashad 15 (29th June 2022). The company is about to issue an IPO to the public. The company has issued 900,000 shares with a face value of Rs 100 per share for the residents of the project-affected areas, of which only 281,750 shares have been distributed.

Out of the total shares to be issued, 2 percent or 39,365 shares have been reserved for the employees and 5 percent or 98,413 shares have been distributed to the collective investment fund. The general public will be able to apply for the remaining 18 lakh 30 thousand 472 lots.

The IPO issuance will be closed on the 19th of Ashad in early and on the 29th of Ashad (lastly). Applications for the IPO can be submitted by all C-ASWA member banks and financial institutions and their branch offices are approved by the Nepal Securities Board. In addition, applications can also be submitted from the MeroShare app and website.

The issue and sale manager of the company is Global IME Capital Limited. Investors will have to apply for a minimum of 10 lots of shares and a maximum of 1,000 lots.

ICRA Nepal has given ICRNP IRB Plus rating to the company in the rating given for the IPO issue. This indicates a high risk in the company's ability to bear responsibility.

Rating agency ICRA Nepal has given ICRP IRB Plus rating to the IPO issued by the company. This indicates a high risk in the company's ability to bear responsibility.

ICRA Nepal had given a rating grade to the company's IPO on 2078 Chaitra17. The period of the rating is one year from the date of the issue i.e. 2079 Chaitra 14.

Himalayan Hydropower Limited was registered as a private limited company in the Office of the Registrar of Companies on 22nd Mangsir 2066 as per the Companies Act 2063. It has been operating as a public company since 2074 Baishakh 28.

Registrar's Office of the Company Kathmandu Municipal Corporation Ward no. 10. Buddhanagar is located in Kathmandu. The project office of the company and the hydropower station are located in Madi village municipality ward no. 2.

The company has already completed the construction work of Namarjuj Madi Hydropower Project with a capacity of 11.88 MW. The project has been generating commercial electricity since 12th Ashoj 2077.

After the completion of the construction work, the total cost of the project is Rs 2.64 billion and the cost per MW is Rs 223 million, according to the company.

Also, the return period of ordinary investment is 9.94 years and the return period of discounted investment is 17.07 years.

The company has developed a future plan for the growth of its business or service and a phased strategy for achieving such a plan.

The company aims to establish itself as a leading company in hydropower development in Nepal. Similarly, the company has stated that it will study the feasibility of new hydropower projects and build other hydropower projects as well.

The company has stated that it can invest in commercially viable hydropower projects to achieve its objectives, considering its capital and liabilities as well as other commercially viable hydropower projects.

For this purpose, the company is ready to identify potential projects, study such project companies and find out whether it is suitable to invest in them, and adopt a strategy to invest in the projects that are suitable for investment.

The company has stated that it will adopt a strategy of paying special attention to get proper return on investment while making investment decisions.