Bank Profit Decline due to Coronavirus Pandemic:

The net profit of banks, which had earned high profits in the past despite armed conflicts, earthquakes, and blockades, has declined in the third quarter of the current fiscal year. The net profit of commercial banks declined in the third quarter of the current fiscal year compared to the same period last year due to intense competition among banks and avoidance of Covid-19 infection.

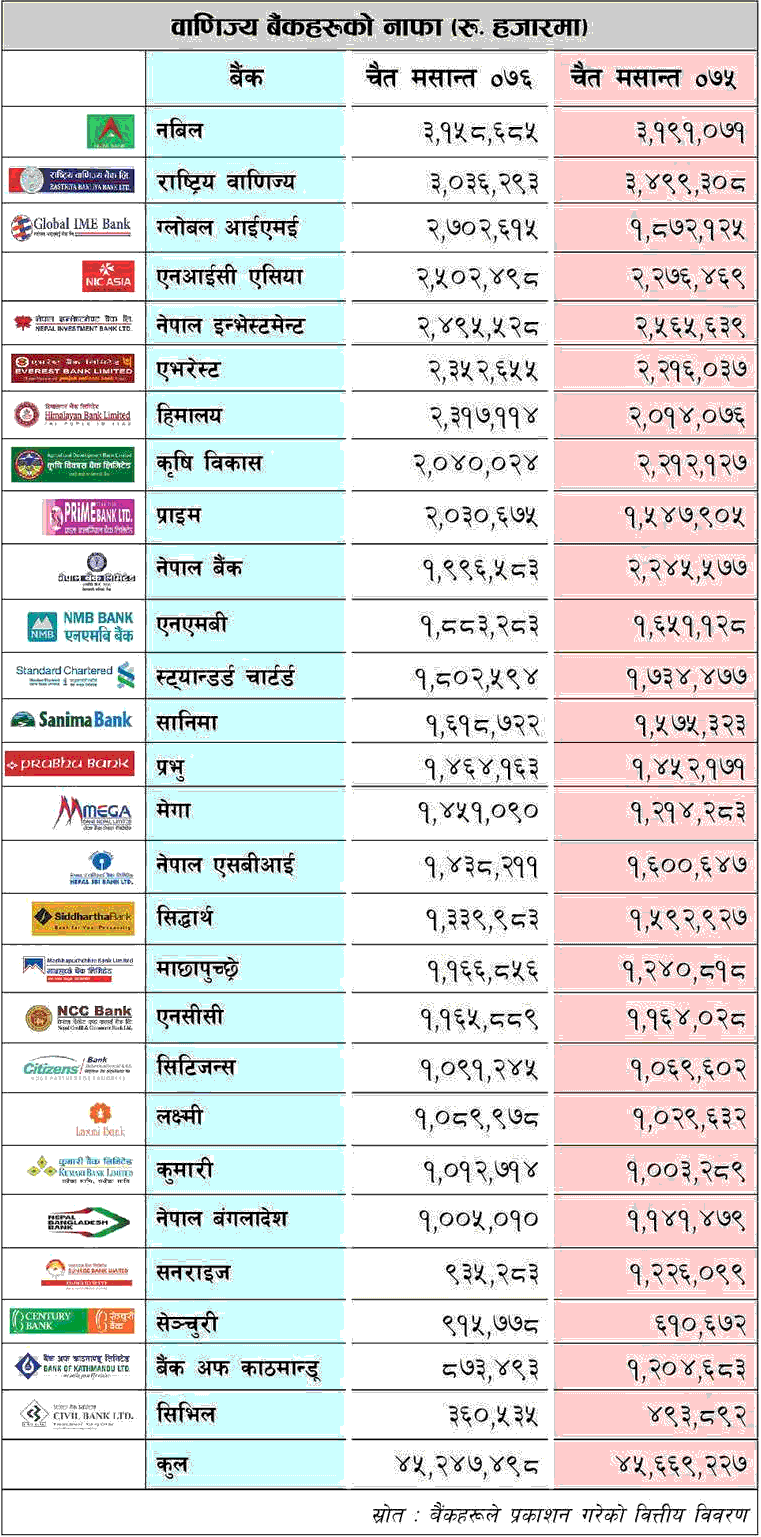

The total profit of 27 commercial banks stood at Rs 45.24 billion as of the third quarter. This is about 1 percent less than the same period last year. As of the third quarter of last year, the net profit of these banks had increased by about 15.5 percent to Rs. 45.66 billion. Similarly, the profit of banks had increased by 6.5 percent until last December.

The study report of NRB also pointed out that banks and financial institutions will not be affected due to the lockdown. The study concludes that even if the profit decreases this year as compared to last year, there is no possibility of loss. "Credit expansion of banks and financial institutions has been stopped," said an NRB spokesperson and study

Task Force Coordinator Gunakar Bhatta said, "That is why the profit growth rate has shrunk." But there is no deficit. '

He said that the banks would not have to incur losses as they would continue to earn interest income from the loans invested even if new loans were not extended. "We have been doing regular business for the first nine months of the current fiscal year," he said.

He claimed that there would be no loss as the banks and financial institutions had disbursed loans above the base rate. As per the NRB directive, banks and financial institutions have given a 10 percent discount on the interest rate till April and will have to reduce the interest rate from April to July by 2 percentage points. He said that the directive did not reduce the interest income of the bank. At present, various facilities have been provided to the banks for mobilizing resources. He said that the banks and institutions will not be harmed due to these reasons.

Banks have now published financial statements up to Chaitra. It also includes transactions during the 20-day lockdown period. Experts say that this is not the only reason for the decline in profits. Chairman of the Bankers' Association Bhuvan Dahal said that the net profit has shrunk due to the competition among the banks and the impact of some downturn. "There are only 20 days of lockdown until the third quarter," he said, "so the bank's profit is likely to decline further in the coming quarter."

Similarly, as per the directive of NRB, banks have given a 10 percent interest discount to customers who pay installments in Chaitra. This has also put pressure on net profit, bankers said. NRB has provided facilities to banks and financial institutions in the form of transitional status so that even the uncollected interest can be counted as income, 100 percent loan can be disbursed on long-term term deposits, and classification of loans. They claim that even if they get these facilities, the profit of the banks will decrease in the coming days. "Banks now include unpaid interest in their profits," said the chief executive officer of one of the banks.

Even before the shutdown, banks' profits had begun to decline. The decline in operating profit due to the non-growth of business as expected, a decrease in the spread between loans and deposits, an increase in operating expenses, and other reasons have reduced the growth rate of profit. Banks, which have been making high profits in previous years, have been limited to single-digit growth since the beginning of the current fiscal year. In the first quarter of this year, the net profit of banks had increased by only 5 percent.

In previous years, banks have been accused of making high profits even in awkward situations as they continue to make high profits. Looking at the situation in the last quarter, there is no high-profit situation in the market. Investor confidence has not increased since the beginning of the current fiscal year. This has had a direct impact on credit flow. Banks have reached remote villages as per the government's policy. That has increased costs. But experts say profits have shrunk because costs have not risen as costs have risen.

To see how much profit a financial institution has made in a given period, it is necessary to look at its operating profit. Operating profit shows profit earned only from financial activities during the period. Net profit is calculated by deducting tax and various fund deductions on operating profit. Other income is also added to the net profit including bad loan recovery of the bank. Banks' operating profit growth was negative at an average of 2.10 percent in the third quarter. 64.40 billion in the corresponding period of the previous year.

Although the bank's profit growth rate was negative until last April, nine banks have earned more than Rs 2 billion. Of them, Nabil Bank and Rastriya Banijya Bank have a profit of more than Rs 3 billion. Compared to the third quarter of last year, the net profit of both banks has decreased. Similarly, the profits of Global IME, NIC Asia, Nepal Investment, Everest, Himalaya, Krishi Bikas Bank, and Prime Bank are more than Rs 2 billion. Among them, the profits of Global IME and Prime Bank have increased this year due to mergers and acquisitions. Last year, the profit of both banks was less than Rs 2 billion. Of the remaining 14, the profit is more than Rs 1 billion, while the profit of four is less than Rs 1 billion.

Deposits of banks increased by an average of 16.71 percent and credit flow increased by an average of 16.47 percent during the review period. By the third quarter, 22 banks' shareholder returns (ROEs) had declined, while those of five banks had risen slightly.