A Comprehensive Look at Remittance and Debt in Nepal

According to a recent government study, approximately 76.8% of Nepal's 6,660,841 households receive remittances. The National Statistics Office's recent living standards survey revealed that about 5,115,526 households in Nepal receive remittances. This represents a significant increase of about 21 percentage points compared to a decade ago, when 55.8% of households received remittances.

The survey indicates that the rise in remittance-receiving households is due to the increasing number of Nepalese seeking employment abroad and students studying overseas who send money back home. In the fiscal year 1995/96, 23.4% of households received remittances, which increased to 31.9% in 2003/04.

Increase in Remittance Amounts Per Household

Compared to a decade ago, the average remittance amount received per household has also increased. On average, each household now receives NPR 145,093 in remittances. A decade ago, the average was NPR 80,436 per household. The survey also shows that 21.3% of the total remittances come from India, with the remaining from other countries. Remittances contribute 33.36% to the total income of remittance-receiving households, with an average per capita remittance of NPR 51,438. Of the total remittances received, 72.4% are used for daily consumption.

Utilization of Remittances

The survey outlines the various uses of remittances:

- Daily Consumption: 72.4%

- 15.8% for debt repayment

- 4.6% for domestic education

- 0.6% for foreign education

- 1.2% for capital formation

- 0.4% for business or investment

- 1.9% for property acquisition

- 1.9% for savings

- 1.2% for other areas

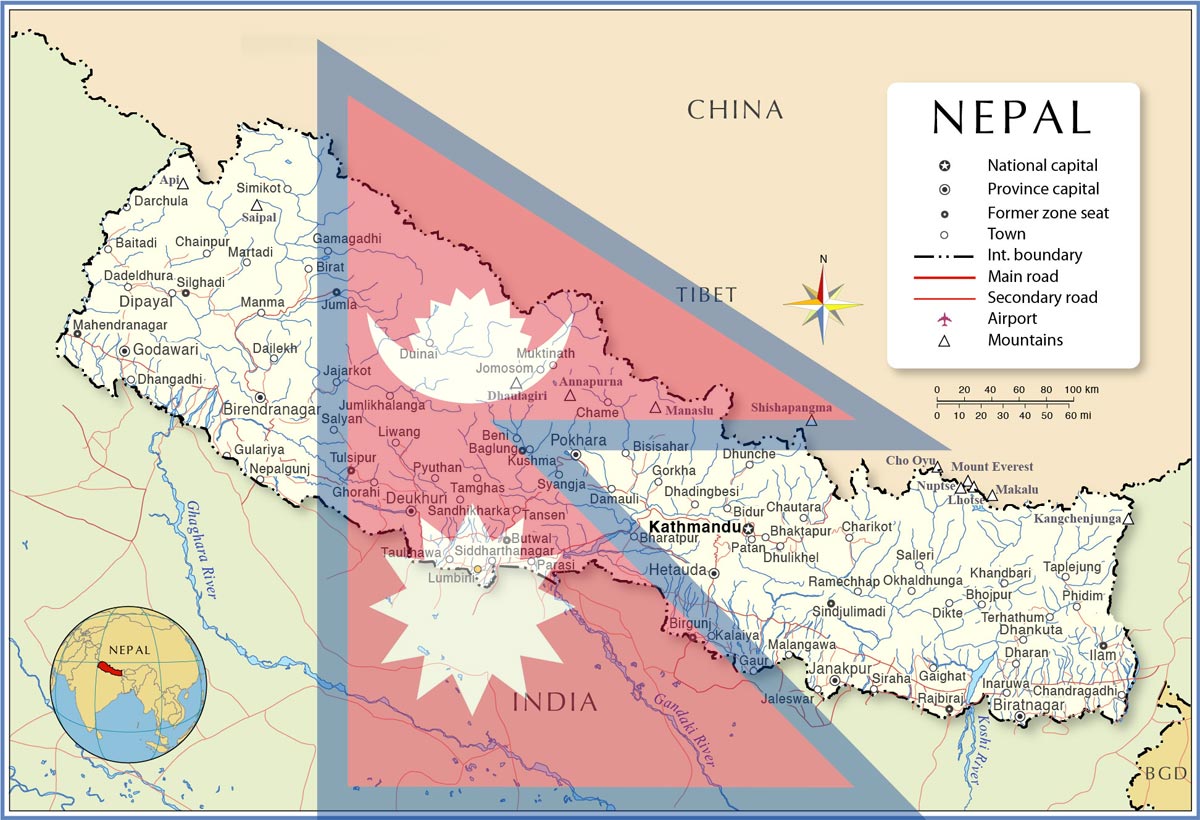

Regional Distribution of Remittance-Receiving Households

Regionally, Lumbini Province has the highest percentage of remittance-receiving households at 89.6%, while Koshi Province has the lowest at 69.3%. In Bagmati and Sudurpaschim Provinces, 69.8% and 69.3% of households receive remittances, respectively. Madhesh Province has 79.1%, Gandaki has 81.1%, and Karnali has 83.9%.

Monthly Remittance Inflows

For the past year and a half, Nepal has been receiving over NPR 1 billion in remittances every month. In the current fiscal year's 10 months, the highest remittance inflow was NPR 137 billion in Ashoj, and the lowest was NPR 105 billion in Magh. In Baisakh, the remittance inflow was NPR 116 billion. Consequently, the country's foreign exchange reserves have reached new heights, setting a record of NPR 1,942.40 billion by the end of Baisakh.

Remittance Growth Trends

Although there was a decline in remittances in Baisakh compared to the previous month (Chaitra), remittances for the first 10 months of this fiscal year have increased by 23.4% compared to the same period last year. Experts attribute the continuous rise in remittances and improvements in tourism and other sectors to the increasing foreign exchange reserves. According to the Nepal Rastra Bank, remittances for the first 10 months of the current fiscal year amounted to NPR 1,198.60 billion, a 19.2% increase from the previous year. In US dollar terms, remittances grew by 17.1%, reaching USD 902 million.

Debt Trends in Nepal

Over the past decade, the number of households taking loans has decreased, but the number of households with outstanding loans has significantly increased, according to the living standards survey. In the fiscal year 2079/80 BS, 63.8% of households had at least one loan, compared to 65% in 2067/68 BS. However, the survey shows that 97.3% of those with loans still have outstanding debt. About 6.4% of households have debt remaining from six years ago, and 46.1% have loans taken within the last one to two years. Households with loans less than a year old make up 47.5%.

Sources of Loans

Households borrow from various sources, including friends and family (42.5%), banks and financial institutions (22.4%), cooperatives (18.3%), and moneylenders (11.4%). Although borrowing from friends and moneylenders has decreased, these groups have not significantly shifted to banks and financial institutions, with only a 2% increase in borrowing from these formal sources. The reliance on cooperatives for loans has increased.

Purpose of Loans

The survey found that 55.8% of loans are taken for personal expenses, 23.5% for household management, and 20.7% for business purposes. Additionally, 64.9% of households take unsecured loans. The high number of unsecured loans is due to the preference for borrowing from friends and moneylenders, indicating that informal loan sources remain prevalent. A study by the Central Department of Economics at Tribhuvan University in January 2020/21 found that the size of the informal economy in Nepal is 41.31%.

Conclusion

Remittances play a crucial role in the economy of Nepal, significantly contributing to household incomes and foreign exchange reserves. However, the heavy reliance on remittances for daily consumption and debt repayment highlights the need for better financial management and investment in sustainable economic activities. Additionally, the rising trend of households with outstanding loans calls for improved access to formal financial services and better debt management strategies.

To ensure economic stability and growth, it is essential to address the challenges in both remittance utilization and debt management. Strengthening financial literacy, promoting savings and investments, and enhancing access to formal financial institutions can help maximize the benefits of remittances and reduce the reliance on informal loan sources. By addressing these issues, Nepal can pave the way for a more resilient and sustainable economic future.

Statistics:

|