National Tax Day (Rastriya Kar Diwas) is going to be celebrated throughout the week. The Internal Revenue Department has informed that it is going to celebrate Tax Day by holding various programs for a week from today. Ritesh Kumar Shakya, director general of the department, said that on the occasion of National Tax Day, every taxpayer's office is going to honor the first taxpayer, hold various discussions and interact with umbrella organizations of taxpayers including industrialists. The theme of this year's Tax Day is 'A broad tax base with voluntary participation: the basis of a sustainable and productive economy'.

Director General Shakya said that the department is working to encourage taxpayers to pay taxes voluntarily and to make the tax payment system technology-friendly. "We are working to make the process of paying taxes technology-friendly and to ensure that taxpayers do not have to be physically present in the process from registration to completion," he said. In order to improve the tax payment system, the department is conducting the 'Tax Administration Diagnostic Assessment Tool' (TADAT) with the help of the International Monetary Fund and Business Process Engineering (BPR) with the help of the German Cooperation Agency. Work is being done to modernize and improve the tax system. We have changed the schedule of details to be submitted by taxpayers. We expect that tax evasion will be reduced due to this," said Director General Shakya.

There are a total of 84 offices under the department, including large taxpayer offices, medium-level taxpayer offices, 43 internal revenue offices and 39 taxpayer offices.

According to the department, by the end of last June, the number of taxpayers with the professional and personal permanent account numbers (PAN) has reached 48 lakh 12 thousand seven hundred and 17. By the end of June 2078, this number was 44 lakh 49 thousand one hundred and nine. In other words, in the last financial year 2078-79 only, 763 thousand 608 taxpayers have been added. Now the number of taxpayers with professional permanent account numbers has reached 1762 thousand 413.

There are 3 million 50 thousand 3 hundred and four taxpayers with personal permanent account numbers (PAN). According to the department, in the last financial year, 211,866 taxpayers under the Professional Permanent Account Number (B-PAN) and 596,372 taxpayers under the Personal Permanent Account Number have been brought under the tax scope. In the last financial year of the government, the total revenue collection was 10 trillion 67 billion 95 crores. In which the share of internal revenue alone is equal to 44 percent.

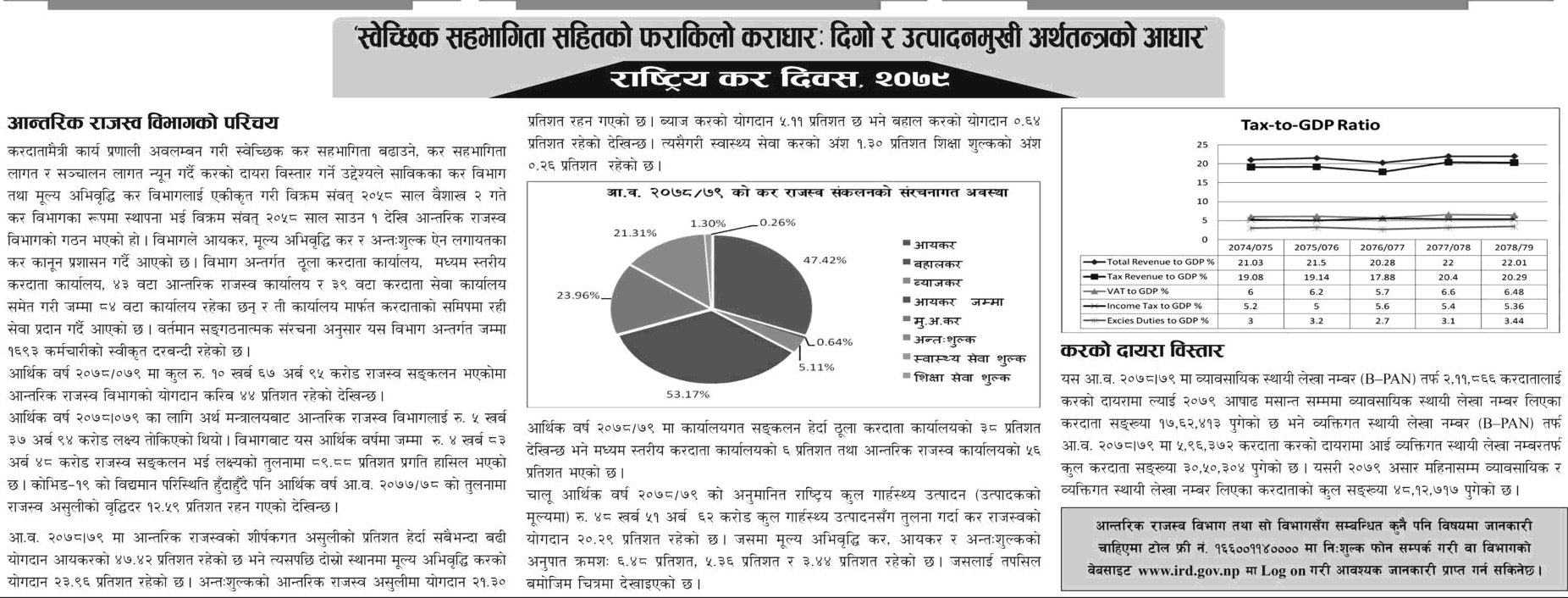

On the domestic side, the government had set a target of collecting revenue of five trillion 37 billion 94 billion, but four trillion 83 billion 48 billion was collected. Which is equal to 89.88 percent of the annual target. However, compared to the previous financial year, the revenue growth rate of the last financial year is 12.59 percent higher. In the last fiscal year, looking at the percentage of collection under the heading of internal revenue, the highest contribution of income tax was 47.42 percent.

Likewise, the contribution of value added tax is 23.96 percent and the contribution of excise duty is 21.30 percent. The contribution of interest tax is 5.11 percent while the contribution of deferred tax is 0.64 percent. The share of health care tax is 1.30 percent and the education fee tax is 0.26 percent.

In the last fiscal year, 38 percent of the internal revenue was collected from large taxpayer offices, six percent from medium-level taxpayer offices, and 56 percent from the Internal Revenue Office, the department said.

Similarly, the contribution of tax revenue is 20.29 percent compared to the estimated national gross domestic product (at production value) of 48 trillion 51 billion 62 billion last fiscal year. In which the ratio of Value Added Tax (VAT), income tax, and excise duty is 6.48 percent, 5.36 percent, 5.36 percent, and 3.44 percent respectively.