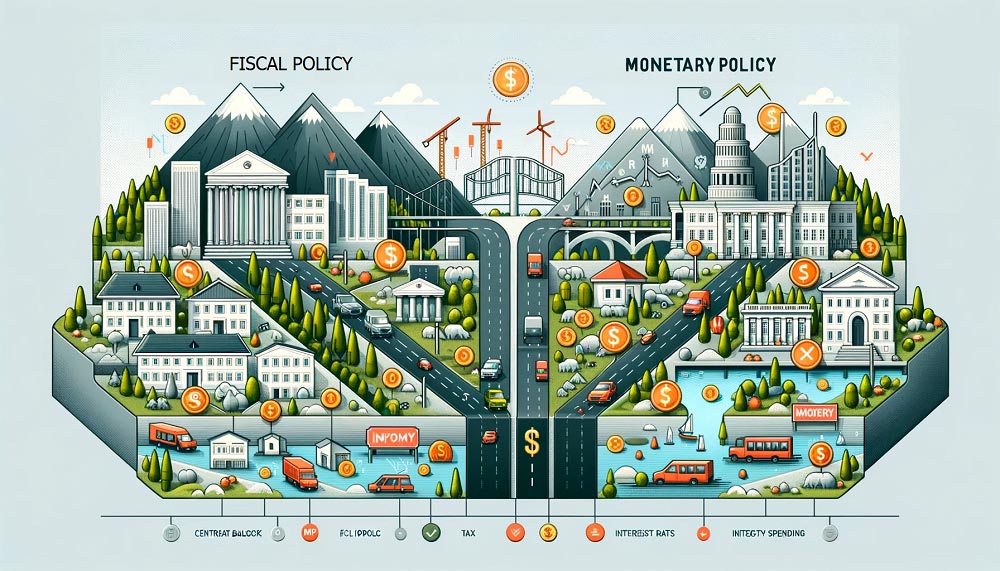

Difference Between Fiscal & Monetary Policy Explained

In the complex world of economics, understanding the nuanced differences between fiscal policy and monetary policy is crucial for students, policymakers, financial analysts, and the general public interested in the mechanisms driving economic stability and growth. This article aims to shed light on these critical economic strategies, delving into their definitions, objectives, tools, and impacts on the economy. By comparing and contrasting fiscal and monetary policy, we provide a comprehensive overview that is informative, analytical, and engaging, adhering to the principles of accuracy and clarity.

Understanding Fiscal and Monetary Policy

What is Fiscal Policy?

Fiscal policy refers to the government's use of public spending and taxation to influence the economy. Managed by the national government, it aims to achieve economic stability, stimulate economic growth, manage inflation, and reduce unemployment. Fiscal strategies involve adjustments in government expenditures, tax policies, and public debt management.

What is Monetary Policy?

Monetary policy, on the other hand, is controlled by the central bank of a country (such as the Federal Reserve in the United States) and involves managing the money supply and interest rates to control inflation, stabilize currency, and achieve full employment. Tools of monetary policy include open market operations, the discount rate, and reserve requirements for banks.

Key Objectives and Tools

Objectives of Fiscal Policy

- Economic Growth: Through increased government spending (capital expenditures) and tax cuts, fiscal policy can stimulate demand and spur economic growth.

- Inflation Control: By adjusting spending and taxation, the government can control inflation. Reducing spending or increasing taxes can help cool an overheating economy.

- Employment: Fiscal policy aims to reduce unemployment by creating job opportunities through government spending on projects and infrastructure.

Objectives of Monetary Policy

- Price Stability: The primary goal is to manage inflation and keep prices stable, ensuring a healthy economy.

- Economic Growth: By managing interest rates, monetary policy can influence borrowing, spending, and investment, thereby affecting economic growth.

- Financial Stability: It also aims to maintain the stability of the financial system by preventing excessive money supply growth and managing interest rates.

Tools of Fiscal Policy

- Government Spending: An increase in public spending can stimulate economic activity, while a decrease can slow the economy down.

- Taxation: Adjusting tax rates can influence the purchasing power of consumers and investment decisions of businesses.

Tools of Monetary Policy

- Open Market Operations: The purchase and sale of government securities to control the money supply.

- Discount Rate: The interest rate charged to commercial banks for loans obtained from the central bank.

- Reserve Requirements: The amount of funds that banks must hold in reserve against deposits.

Comparative Analysis on Their Impact on the Economy

Fiscal and monetary policies have distinct mechanisms for influencing the economy, with their effectiveness varying based on the economic context and implementation timing.

- Impact on Inflation: Monetary policy directly influences inflation by controlling the money supply and interest rates. Fiscal policy impacts inflation indirectly through demand stimulation via spending and taxation.

- Economic Growth: Both policies can stimulate economic growth, but fiscal policy does so by increasing demand through government spending and tax cuts, whereas monetary policy influences growth by managing interest rates and liquidity.

- Employment: Fiscal policy can create direct employment opportunities through government projects, while monetary policy indirectly influences employment by affecting economic conditions and business investments.

Examples in Action

- Fiscal Policy Example: The American Recovery and Reinvestment Act of 2009, aimed at countering the Great Recession, included tax cuts, expansion of unemployment benefits, and increased public spending.

- Monetary Policy Example: During the financial crisis of 2008, the Federal Reserve lowered the federal funds rate to near zero and used quantitative easing to increase money supply and stimulate the economy.

Advantages, Limitations, and Effectiveness

Advantages

- Fiscal Policy: Direct control over spending and taxation allows for targeted interventions in specific sectors.

- Monetary Policy: Can be implemented more quickly than fiscal policy, with central banks adjusting policies as needed without legislative delay.

Limitations

- Fiscal Policy: Can lead to increased public debt if not managed properly. It may also have delayed effects due to the time it takes to enact and implement legislation.

- Monetary Policy: Has indirect effects on the economy, which may not be immediately apparent. There's also a risk of overstimulation leading to inflation.

Effectiveness

The effectiveness of fiscal and monetary policy varies. Fiscal policy is particularly effective in times of economic downturn when there's a need for direct government intervention and spending. Monetary policy is crucial for controlling inflation and stabilizing the currency over the long term.

Conclusion

Understanding the differences between fiscal and monetary policy is fundamental to grasping how governments and central banks influence economic conditions. While both aim to promote economic stability and growth, they operate through different mechanisms and tools. Fiscal policy, managed by the government, uses public spending and taxation to impact the economy directly. In contrast, monetary policy, controlled by the central bank, involves managing the money supply and interest rates to achieve its goals. Each has its advantages and limitations, and their effectiveness depends on the economic context and the challenges at hand. By employing these policies judiciously, policymakers can steer the economy towards growth, stability, and prosperity.

Economics